⭐ The Ultimate Guide to Passing a Prop Firm Challenge in 2025

How Smart Traders Secure Funding & Scale Their Forex Career

Prop firm challenges have become one of the most powerful opportunities for Forex traders to access large trading capital without risking their own savings. In 2025, the prop firm industry is booming, providing traders with instant access to £10,000 to £500,000+ funded accounts once they pass an evaluation.

If you’ve been researching how to pass a prop firm challenge, the best prop firms, or what rules apply before receiving a funded account, this complete guide breaks down everything you need to know — from strategy to psychology.

✅ What Is a Prop Firm Challenge?

A prop firm challenge is a trading evaluation offered by proprietary trading firms. They test your ability to trade profitably while maintaining strict risk rules. If you pass, the firm will fund you with real capital and split profits with you — typically 70% to 90% going to the trader.

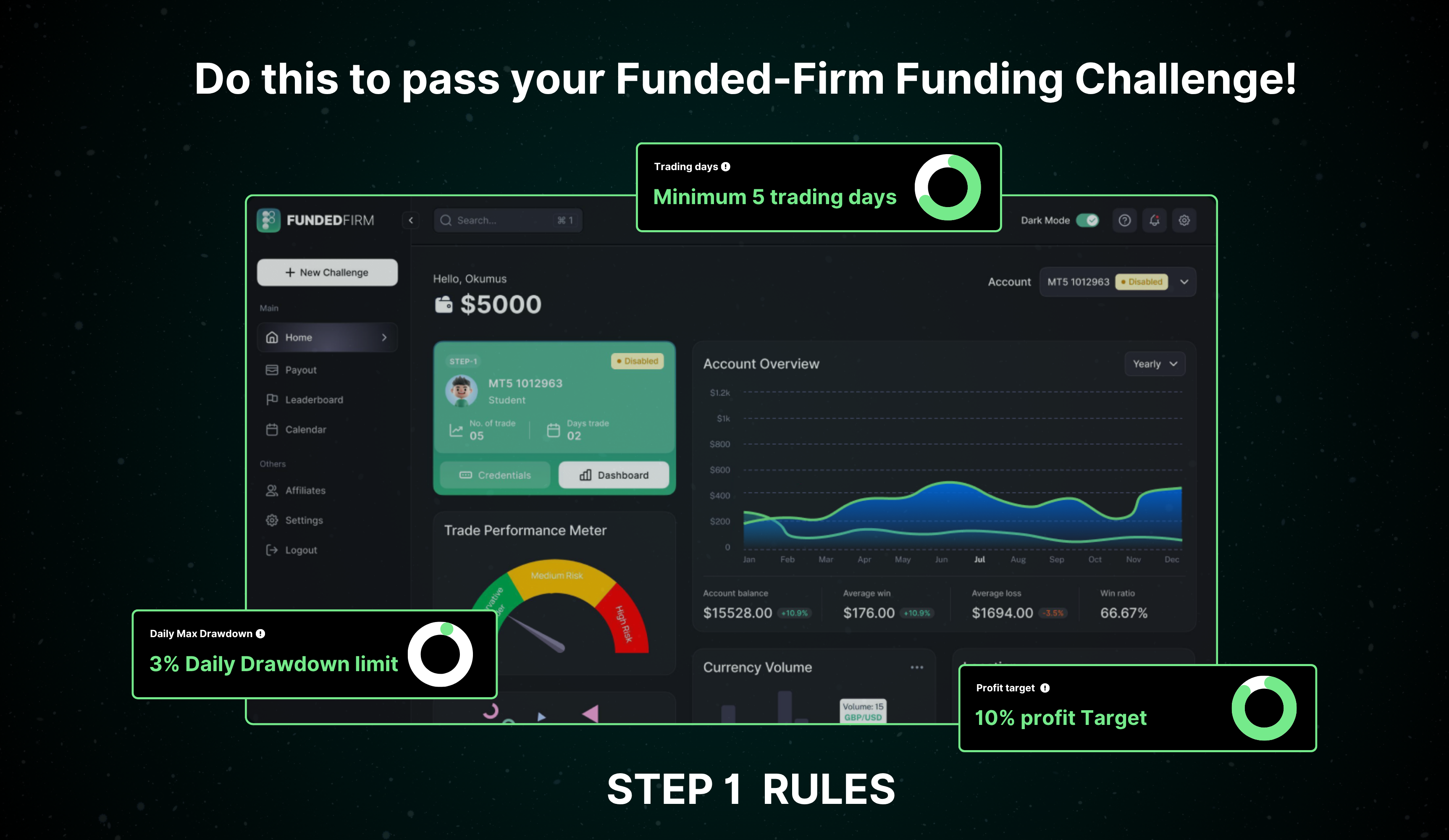

The evaluation normally includes:

-

Minimum profit target (5% to 10%)

-

Daily drawdown limits (usually 3% to 5%)

-

Overall drawdown limits (8% to 10%)

-

Restricted news trading (depending on the firm)

-

Time limits (sometimes 30 days, sometimes unlimited)

These rules exist to prove you can trade consistently, not emotionally.

⭐ Why Prop Firms Are the Future of Trading in 2025

In 2025, thousands of traders choose prop firms over traditional retail trading because:

1. You Risk Almost Nothing

You pay a fee for the challenge — usually £100–£500 — instead of risking your own capital.

2. Instant Access to Big Capital

Passing gives you access to accounts ranging from £10k to £500k or more.

3. Huge Profit Splits

Top prop firms give up to 90% profit split to successful funded traders.

4. Scalable – Fast

Most prop firms allow scaling up if you perform well.

Example: £50k → £100k → £200k → £500k.

5. The Challenge Builds Discipline

The strict rules force traders to master:

-

Risk management

-

Daily loss limits

-

Consistent entries

-

Psychology

This is why passing a prop firm challenge is now seen as the ultimate professional trading test.

🎯 How to Pass a Prop Firm Challenge (Elite Blueprint)

Passing a prop firm challenge is more about discipline than wild trades. The evaluation is designed to catch emotional traders. Follow this blueprint to dramatically increase your chances.

1. Trade With Lower Lot Sizes Than You Think

If you normally trade 1 lot, drop to 0.2–0.3 lots during the evaluation.

Challenges are not about making fast money — they are about staying in the game.

Why this works

Smaller lots =

2. Use One Trusted Strategy (Not 10)

Consistency is the #1 tested skill.

Stick to:

The best funded traders pass using one A+ setup, not 10 random strategies.

3. Only Trade High-Probability Sessions

London Open and New York Open are the highest-volume times.

Avoid:

-

Dead markets

-

Low liquidity

-

Overnight ranges

4. Never Trade Against News Events

Many prop firms restrict news trading.

Even if allowed, NFP, CPI, FOMC can violate your drawdown in seconds.

5. Set a Hard Daily Limit: 1–2 Trades Only

Overtrading is the #1 reason traders fail prop firm challenges.

Your goal is consistency, not revenge.

6. Stop Trading After Hitting 1% Profit in a Day

Professional traders know the secret:

Small consistent gains beat big risky wins.

At just 1% per day you pass most challenges in 10–15 days WITHOUT stress.

🧠 Trading Psychology: The Hidden Prop Challenge

Prop firms are not testing your strategy…

They are testing your emotional control.

You must eliminate:

-

Fear of loss

-

Revenge trading

-

FOMO entries

-

Random lot size changes

-

Trading out of boredom

The traders who pass are the ones who remain calm during:

-

Losing streaks

-

Drawdowns

-

Missed trades

Your mindset is more important than your chart.

⭐ Best Prop Firms in 2025 (Most Trusted)

Here are the prop firms traders trust the most:

1. FTMO

The most reputable worldwide.

Great analytics, great scaling, strict but fair rules.

2. The Funded Trader

High profit splits + solid community.

3. MyFundedFX

Excellent for Forex traders; clear rules.

4. Lux Trading Firm

UK-based; slower, realistic trading conditions.

5. True Forex Funds (when available)

Temporarily closed in 2023 but expected reforms.

(Always research updated status before buying any challenge.)

📈 What Happens After You Pass the Challenge?

Once you pass:

-

You complete the verification phase (if required).

-

The firm assigns you a funded live account.

-

You begin real trading with profit splits.

-

Many firms offer scaling — up to £1M+.

Passing a prop firm challenge is one of the fastest ways to become a professional trader in the global market.

🏆 Final Word: Prop Firm Challenges Are the Gateway to Big Capital

If you dream of becoming a professional trader, a prop firm challenge is the most accessible and affordable path.

With the correct:

-

risk management

-

psychology

-

trading strategy

-

discipline

—you can scale to large funded accounts and build real financial freedom through Forex.